by

Stacy Wise

| Sep 20, 2021

Did you know MNB offers Personal Credit Cards?

Written by Andrea Klinedinst, Compliance Assistant

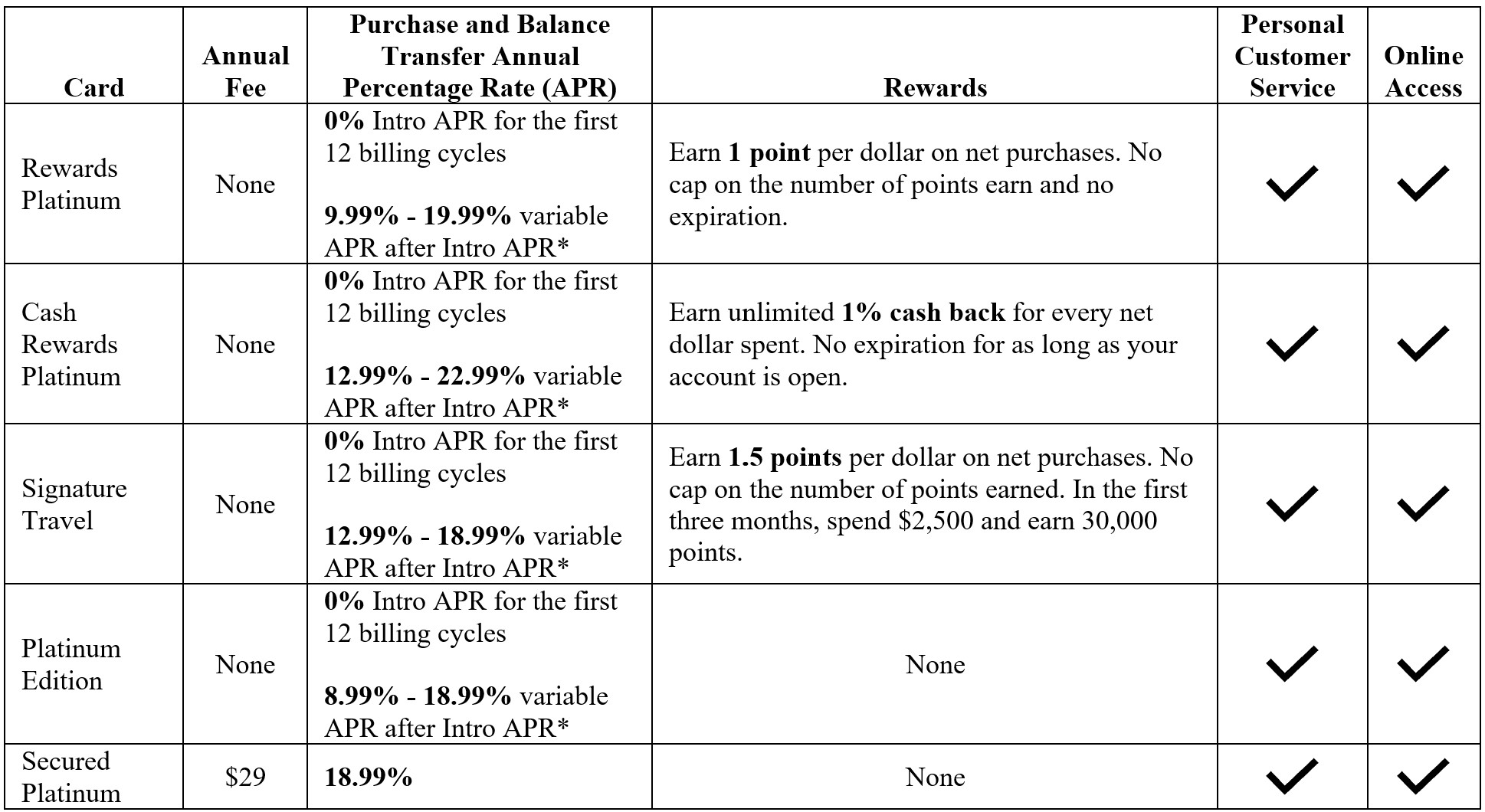

We offer 5 types of personal use Visa® credit cards, all with great benefits to fit your needs. You can apply for Rewards Platinum, Cash Rewards Platinum, Signature Travel, Platinum Edition, and Secured Platinum cards. Check out the great benefits of our cards below and compare them with other cards to see if an MNB credit card is for you!

*All variable APRs are based on credit worthiness.

OTHER BENEFITS

All 5 cards

- With our credit cards, you can get a great competitive rate on your Purchase and Balance Transfer APR. After the Intro APR, all variable APRs are based on credit worthiness (The Secured Platinum card does not offer the Intro APR).

- Our cards also come with 24/7 Personal Customer Service based in the US. By contacting the customer contact center, you will receive the type of personal customer service you associate with MNB.

- As a cardholder, you can sign up to have online access for your accounts to make payments, set up alerts, enroll in eStatements, and even view your FICO® Score for free.

Rewards Platinum

The Rewards Platinum card is great option if you want to earn points to redeem for merchandise such as electronics and jewelry and for travel needs like airline tickets with no blackout dates, hotels, and car rentals. For each dollar on net purchases, you can earn 1 point with no cap on the number of points you can earn and no expiration. The points are redeemable on cRewardsCard.com.

Cash Rewards Platinum

The Cash Rewards Platinum card is the way to go to start earning cash back on your everyday purchases. For every net dollar spent, you can receive unlimited 1% cash back with no expiration for as long as your account is open.

Signature Travel

If you like to travel or travel often, the Signature Travel card offers many great travel perks and bonus rewards. This card comes with Visa Signature® Perks for travel and bonus rewards that can be redeemed for merchandise and travel needs.

Some Visa Signature® Perks include:

- Travel discounts on rental cars

- Complimentary upgrades at hotels, resorts, and spas

- Special access to sporting events, wine and food events, and many more

- Travel insurance of up to $1,000,000

- Visa Signature® 24/7 Concierge Service to help with tickets or restaurant reservations

As an additional bonus, for each dollar on net purchases, you can earn 1.5 points with no cap on the number of points earned. When you spend $2,500 in the first three months, you can earn 30,000 points. The points are redeemable on cRewardsCard.com for merchandise and travel needs like rental cars, cruises, hotels, and airline travel. Airline tickets work for any airline with no blackout dates.

Platinum Edition

If you’re looking for a straightforward credit card, the Platinum Edition is a great choice with competitive rates and the other great additional features included with all our credit cards (see below).

Secured Platinum

If you’re just starting to build or want to rebuild your credit, the Secured Platinum card is a great option to consider. With a secured card, you make a security deposit of at least $300 up to $5,000, which becomes your credit limit, less the annual fee of $29. This card helps build credit by reporting payment and usage history to the three major credit bureaus. With responsible use, you may become eligible to upgrade to an unsecured credit card in as little as 13 months.

The security deposit will be returned when you upgrade to an unsecured account, or if you decide to close your account, the amount less any unpaid balance will be returned. With this card, you will also have access to educational tools to learn more about FICO® Scores, improving your credit, tackling debt, and overall financial health.

Additional Features for all Cards

- Fraud monitoring and zero fraud liability – You will have zero liability for confirmed cases of fraud.

- Cell phone protection – When you pay your wireless bill with one of these covered cards, you are eligible for theft and damage protection.

- Email and text fraud alerts – With our cards, you can get real time alerts regarding suspicious activity on your account.

- Free FICO® Score – When you sign up for online access, you can track your financial health with your free FICO® Score.

- Mobile payments – Our cards work with Apple Pay™, Samsung Pay™, and Android Pay™, so you can pay safely and securely from your phone.

- Travel Accident Insurance ($150,000) – When you use your card to purchase travel tickets, you can receive travel accident insurance up to $150,000 at no cost (The coverage amount is higher for the Signature Travel card).

If you have any questions about our credit card options, call 877-647-5050 or visit any MNB location to see a Personal Banker today.

To apply for any of these cards or to see more information and disclosures, please visit our Credit Cards page.