How do you pay your friend back for your share of dinner? What if you want to send money to a family member quickly and easily? P2P allows you to instantly send money from your MNB checking account to anyone’s debit card (US only). The recipient doesn’t have to be an MNB customer, and P2P is fully integrated into Online Banking & the MNB Mobile App.

What is P2P?

P2P (“Person-to-Person”) is simply a transfer of funds between your bank account and the bank account of another individual through the MasterCard/Visa system. No physical cash changes hands and the money is sent safely, securely, and directly to a bank account. As a result, transfers are instant with many transfers being completed in just a few minutes.

Features

- Fast – Send money from your account instantly. The funds are withdrawn immediately from your account.

- Convenient – Integrated within MNB’s Online Banking and Mobile App.

- Secure – All information is encrypted.

Get Started Now

P2P is available to MNB checking account customers with Online Banking or the MNB Mobile App. To activate the P2P option, please contact our Customer Service Department at 877-647-5050. Once P2P is activated, follow the instructions below to initiate your transaction.

Log in to MNB's Online Banking / Mobile App

Select "Transfers" in the bottom menu

Select "New Transaction" and choose the MNB account you want to send money from

Select "+ Add New Payee" button

Choose the "Person to Person" option

Provide the individual's first and last name and choose how you would like to send the money (email, text message, or by entering the payment method)

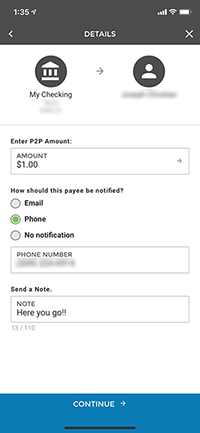

Enter the P2P amount and select how the payee will be notified

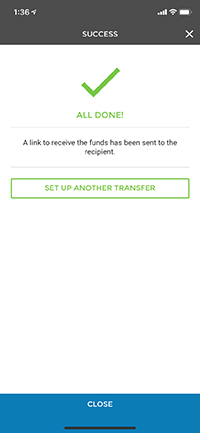

All done!

Questions?

Message and data rates from your wireless carrier may apply.